EU VAT Action team members raised concerns arising from people’s experiences making their first quarter VATMOSS returns at last week’s HMRC Working Group meeting. Hopefully this feedback will be useful.

The ‘light touch’ allowing UK businesses to accept one piece of customer location data has been extended indefinitely beyond the 30th June.

This is good news for UK businesses and we would recommend those of you in other member states press your own tax authorities for a similar concession, enlisting the support of your MEPs and other elected representatives. We still need to make EU governments aware of the massive practical difficulties and unreasonable costs involved in complying with these new rules.

Payments that went astray have now been traced and allocated to the correct VATMOSS accounts.

HMRC tell us that people were notified of non-payment for two reasons. A small number of payments weren’t processed because they had been made on Good Friday – and the computer system couldn’t cope with the idea of a Bank Holiday that wasn’t a Monday… Now this glitch has been identified, we’re assured that won’t happen again.

Rather more people were sent stern letters because their VATMOSS payment had in fact been made to their VAT account incorrectly. All those payments have now been reallocated.

HMRC accept that the VATMOSS payment instructions could certainly be improved to make things clearer.

They’d like to know how and why people found this part of the process confusing. They are open to suggestions on improving layout etc.

Please email vat2015.contact@hmrc.gsi.gov.uk with your comments and ideas.

Going direct to HMRC with your problems and challenges is a powerful and direct way of HMRC getting the message and having firm evidence of the true volume of difficulties.

EU VAT Action remains committed to finding a genuine solution to this law and to working with government bodies to achieve that. However, we cannot be their buffer for the chaos and confusion that has resulted. They need to know directly.

Notifications about your VATMOSS payments are sent via the ‘Secure Communications’ facility included in your account.

People have been understandably concerned not to receive payment confirmations or indeed, any indication that there’s been a problem. It turns out such things aren’t emailed direct but directed to a mailbox attached to your VATMOSS account.

You should get an email notification that there’s a message waiting but there’s every chance that these are being snatched by spam filters. And of course, if you don’t know you should be getting a notification email, there’s no reason why you should go looking for it in the junk mail.

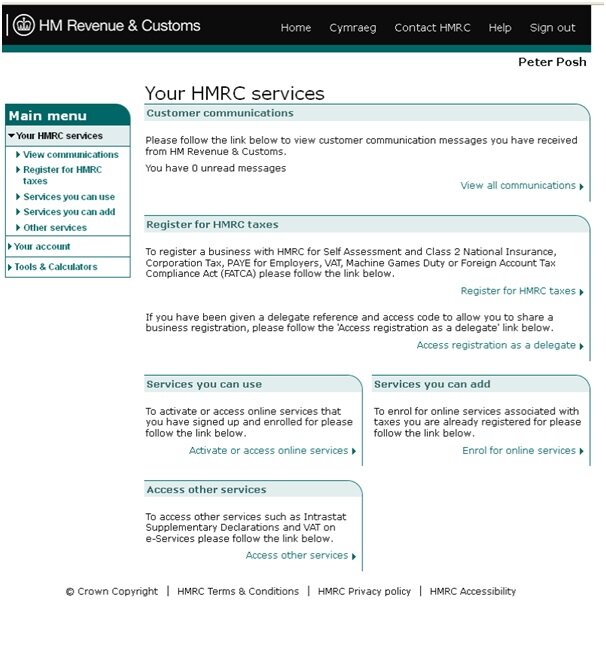

Here’s a shot of the screen you see when you log on to access the VATMOSS service. Clicking ‘view all communications’ will take you to your messages. You can also check that all the necessary boxes are ticked and your details are up to date, so you get email notifications in future.

Other EU tax authorities have been very firmly reminded that their VATMOSS queries should go to HMRC, not direct to UK businesses.

We’re assured there were only a few instances of people getting surprise letters from HMRC’s counterparts in other European countries. This shouldn’t happen again – but if you do get something unexpected from a foreign tax office, you should refer it immediately to HMRC via the email address vat2015.contact@hmrc.gsi.gov.uk.

We’re also assured that the German computer glitch which saw businesses across Europe issued with tax reference numbers for an office in Kleve has been identified and rectified. If you’ve had one of these letters, ignore it!

The EU Web Portal authorities are being asked to improve the information which their website supplies on an ongoing basis.

In particular, HMRC are stressing the need for EU VAT rates information to be kept up to date and to be downloadable/exportable in an electronic format that can be integrated with other software.

HMRC would like to know specifically what UK businesses require from the online resources offered by the EU.

Email vat2015.contact@hmrc.gsi.gov.uk with your comments and ideas.

Hopefully this will help make second quarter VATMOSS returns more straightforward!

Those of you not registered for VATMOSS because of the unreasonable burdens/impossibility of compliance can also contact HMRC to let them know all your EU VAT problems, the challenges for your particular business sector, and any ideas to help at vat2015.contact@hmrc.gsi.gov.uk.

This is how you can help make the most difference and help us all get the best response!