Over the past nine months, the EU VAT Action team has made the case for a VAT threshold cross-border digital sales indisputable. The European Commission and the UK Government has publicly agreed, and revised legislation will be enacted. However, even with the UK Government’s active involvement no EU threshold will […]

Some really good news. David Gauke is the UK’s Treasury Secretary – a key decision-maker in the EU VAT mess / fix possibilities. We met with him in December, to tell him about the problems you have been facing, but had been unable to get another meeting with him since. […]

EUVAT Action: Meeting With David Gauke – Tuesday 22nd September

1

1

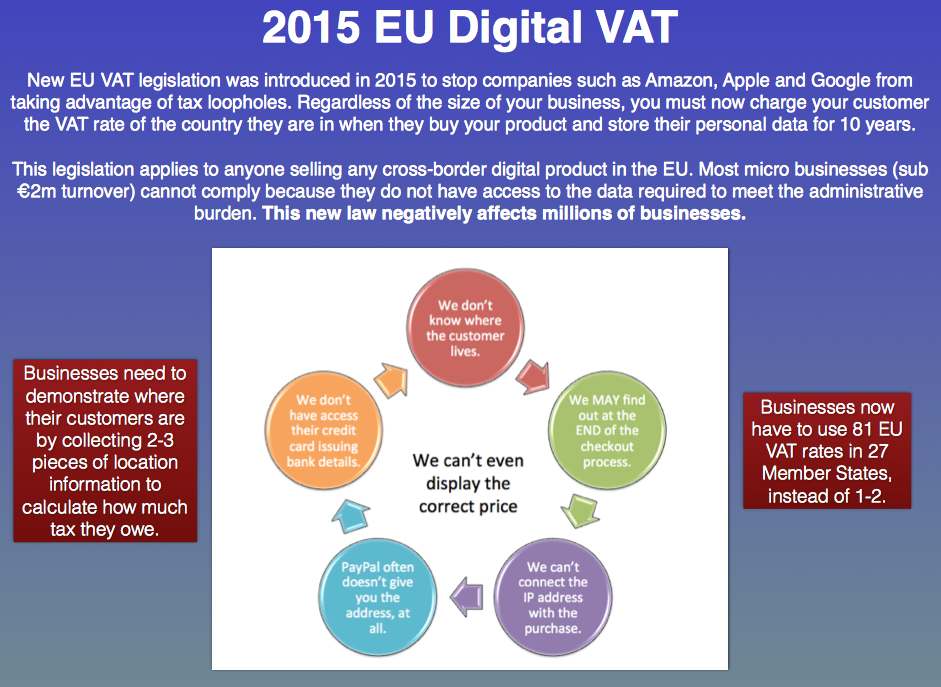

If we’re to find a way forward to save the European digital economy – and every passing month sees yet more damage done – EU countries need to realise they can actually profit by taking small businesses out of cross-border digital VAT. On the other hand, it’s equally important to […]

The VATMOSS Threshold Paradox, Reasons Why Countries Are Wary & ...

Thank you all so much for your support last week when I was at the Fiscalis Summit. Here is a summary of how it went and what our next steps are: In summary: there was widespread agreement that the implementation of the EU Digital VAT rules has hit the smallest […]

What Happened At The EU VAT Fiscalis Summit? #EUVAT #Fiscalis

Clare Josa, Co-Founder of the EU VAT Action Team, is attending the EU Fiscalis event in Dublin over the next three days to represent you. This event represents a pivotal point in the campaign so far, where the campaign and all of your views will be heard by all 28 EU Finance […]

EU VAT Action team at 2015 Dublin Fiscalis Summit

2

2

As the dust from the Irish Revenue Fiasco settles, we can now see what Europe’s smallest businesses think of their chances of selling digital products online, six months after the new EU regulations were introduced. Alongside the opinions of the up-and-coming digital entrepreneurs and other companies keen to expand into […]

Views of VATMOSS & why Europe’s Finance Ministries need to ...

7

7

Hundreds of VATMOSS-registered businesses received letters demanding ridiculous EU VAT payments from the Irish Revenue over the past week. We’re talking demands for up to millions of Euros – only received by VATMOSS-registered businesses. The letters caused stress and confusion – and also huge worry that, if they were a […]

Irish VATMOSS ‘Scam’ Letters & Important EU VAT Action Campaign ...

We now have a chance to convince the EU that they must take decisive action to put a stop to the damage these regulations are going, at the EU Finance Ministers’ summit in Dublin, 7th – 9th September. As long as we can afford to send a representative to speak […]

The EUVAT VATMOSS Campaign. Fundraising to attend a VITAL meeting

1

1

There have been discussions in the forums & the press this week about the EU Commission calling for an exemption threshold for EUVAT (hooray!) for ‘start-ups’ (panic!). Here’s a short video to help you understand why this is simply something getting lost in translation – but also why we URGENTLY […]

Don’t Let The Term ‘Start-Up’ Freak You Out! Still Time ...

10

10

Here’s a short (but very important) video updating you on what has been happening with the EUVAT Action Campaign over the past few weeks – and how we urgently need your help for the next push. We also wanted to let you know about a breakthrough that has happened: thanks […]