As the dust from the Irish Revenue Fiasco settles, we can now see what Europe’s smallest businesses think of their chances of selling digital products online, six months after the new EU regulations were introduced. Alongside the opinions of the up-and-coming digital entrepreneurs and other companies keen to expand into international online trade, to drive the knowledge economy and generate employment and growth.

From 7th-9th September, the Fiscalis Summit in Dublin will see representatives of every EU Finance Ministry discussing how well or badly implementing these new rules has gone.

So we have until that conference to convince the Finance Ministries that this current system is damaging for all businesses and unworkable for those who simply cannot meet the administrative burdens and costs of compliance necessary to sign up for VATMOSS.

Otherwise there is no realistic prospect of seeing meaningful changes to this destructive legislation before 2017/2018.

We need everyone to act, most particularly those outside the UK, to prove this isn’t just a UK concern, which is something far too many other European finance ministries still believe. They’re still only talking to business organisations and the largest companies who can handle all this far more easily than the rest of us.

They need to hear the specific details of the ways this legislation has hurt your business and the changes you’ve had to make in order to just keep trading. However well the VATMOSS payment processing system itself might work is irrelevant if the administrative burdens and costs of compliance are so damaging.

European finance ministries and the tax officials handling all this need to hear from the sole traders, the one-person companies, the part-time start-ups and side-businesses who have been hardest hit by all this, precisely because the Internet now offers so many opportunities for small-scale, direct e-commerce.

Some of those start-ups could have become the next Apple, Amazon or Google. But as long as these new regulations raise such an off-putting barrier to entry into the digital single market, those giants will continue to dominate.

Here’s what Fiscalis needs to know:

Everyone’s agreed that selling digital products outside your own home country has become a nightmare that’s best avoided if you possibly can, and a real headache if you can’t. Either way your business will suffer, so you have to decide what’s the least-worst scenario.

Because it’s now clear that registering to use the VATMOSS system means opening yourself and your business up to direct challenges and potentially audits from 27 European tax authorities in addition to your own, many of whom will be operating in a language you do not read or speak, forcing you to incur translation costs.

You will then be dealing with one or more national tax authorities whose most senior officials:

• were demonstrably unaware of the scope and scale of direct ecommerce in 2015, relying on assumptions made in 2008 and not checking what had changed.

• agreed this system without confirming it was possible for all businesses to comply with the location data requirements.

• implemented this system without notifying, still less consulting, so many of the 3rd party marketplaces which they now decreed were liable for handling all this.

• assumed businesses would be happy to use 3rd party marketplaces without considering the full impact of paying their fees and relinquishing pricing and marketing control.

• assumed businesses would be happy to add multiple stages to their checkout processes without any understanding of the loss of sales (cart abandonment) which would follow.

• assumed technological solutions would be forthcoming thanks to the magic of market forces, without consulting any IT experts who would have explained this was fantasy.

This hardly inspires confidence that their lower level staff will understand the problems which businesses are now facing!

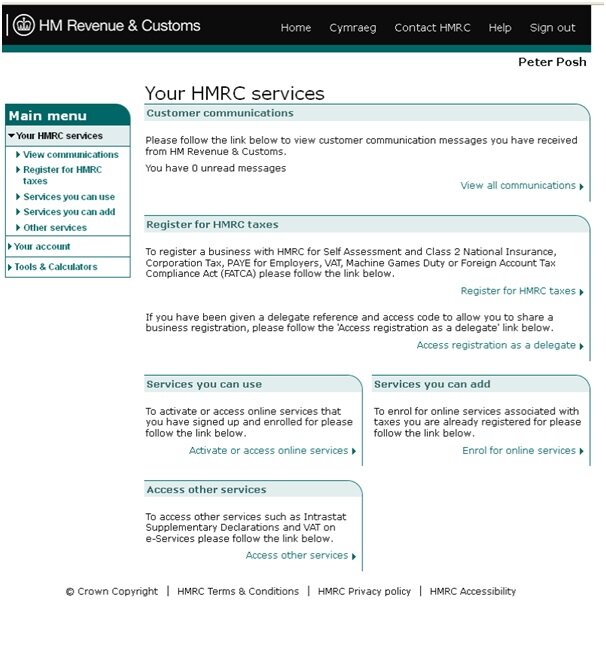

Thankfully within the UK, the HMRC department handling VATMOSS is ready and willing to help when a business is contacted direct by Ireland, Germany, Sweden, Denmark, Luxembourg…

• Though that is not the same as initial assurances that all such queries would be directed to HMRC in the first instance.

• Though that’s easier said than done when calling the helpline means making multiple phone calls and spend 20-30 minutes on hold at a time, assuming you’re not simply cut off because the lines are too busy.

• Whose call takers will often tell you to send your query by email instead.

• Which can take between 4 and 6 weeks to be answered.

Outside the UK, national tax authorities have been telling businesses they’re on their own when it comes to dealing with any VATMOSS-related challenges from other countries. Simply getting that unhelpful answer has proved to be time-consuming and difficult for those businesses affected, who can find little or no meaningful guidance online. European representatives at Fiscalis MUST HEAR this from their own traders.

For those businesses still hoping to take advantage of the digital single market which we’ve all been promised, the challenge is choosing the least damaging option in order to comply, in order to remit often trivial amounts of tax

• incur hundreds, often thousands of pounds/euros in costs and weeks of lost productivity to restructure your business to offer a compliant shopping cart.

• add additional steps into your existing payment system to request location data from your customers, increasing your lost sales (cart abandonment rates).

• display your prices without VAT (even though that’s technically illegal in many European countries) and add varying rates of VAT at the check-out, increasing your lost sales (cart abandonment rates).

• raise your prices to offset the VAT you’ll be paying, thus sacrificing competitiveness, or pay the VAT out of your existing profit margin, thus sacrificing income.

• hand over a percentage of your gross revenue (frequently 30-50%) to a 3rd party platform who will then also gain significant influence if not outright control over your marketing and pricing as well as adding/deducting VAT from your domestic sales even where those sales should be exempt under national tax laws.

• abandon cross-border sales (barring customers by using geoblocking software), sacrificing that revenue in the short term and prospects for growth in the long term. Bearing in mind that’s also a grey area, legally, and in any case, geoblocking can be easily circumvented by a variety of online tricks, rendering you liable for VATMOSS whether you want to register or not.

You must then submit quarterly VATMOSS returns on a fixed, tight timescale which takes no account of sole traders and single-person businesses having holidays, sickness or other personal obligations.

You will be personally liable for making sure you have all the correct and up to date information on whatever VAT rate applies to your products in 28 countries.

You must also keep current with the differing interpretations of what does or does not constitute a VATMOSS-liable sale in 28 different jurisdictions and to make sure you are aware of any changes to those interpretations.

Be prepared to issue VAT invoices according to the varying domestic rules of 28 countries in the correct language

In the UK, you must also register for domestic VAT and submit a nil return each quarter, just to be able to register with VATMOSS, even if your business turnover is below the standard UK threshold.

You can then continue trading at a significant and growing commercial disadvantage compared to your competitors who are either genuinely unaware of, or who have chosen to ignore, this fatally flawed and unworkable legislation.

You will then learn that effective enforcement relies on consumers or other businesses reporting non-compliant sites. That’s right – you’re now the unpaid VAT Police as well as an unpaid tax collector.

All this is bad enough for two-three person businesses who can afford to employ an accountant and to hire IT specialists to build custom websites. For single-person businesses submitting the most basic annual accounts and using free online services and cheap plug-ins, it’s impossible. That’s why those businesses been closing down since January 2015.

Then there’s the alternate view. Please be clear that we are absolutely NOT endorsing or even hinting that businesses consider deliberate non-compliance. We are ONLY reflecting conversations which we are aware of happening online.

What not registering for VATMOSS means in practical terms

Dealing with none of the above.

Waiting to see if any of the tax authorities who seem so plagued by computer glitches and other errors in implementing this system will ever actually do anything to track down non-compliant businesses among the millions of online businesses selling digital products cross-border worldwide.

In the event of that happening, and being pursued for non-compliance, you can challenge that tax authority to prove that you were indeed aware of this legislation and have deliberately chosen not to comply – rather than simply missing out on the news because:

• you don’t follow the right political or governmental accounts on Twitter or other social media.

• you don’t belong to the limited number of self-selecting business organisations which different tax authorities have chosen to brief about this.

• you didn’t happen to read the business magazine or relevant newspaper pages on the particular days when an article that might have alerted you happened to appear.

Assuming you cannot simply demonstrate your reliance on the widespread and persistent misinformation circulating about this system, including advice still being given by qualified accountants in many European countries.

In the event that you are successfully prosecuted, pay the trivial sums owed and a nominal fine that’s almost certainly going to be less than the costs/losses of compliance.

All of this means it’s in every European tax authority’s own best interests to take action as quickly as possible.

• The sooner it becomes quick, easy and cheap to comply with these regulations, the more revenue they will see from digital sellers in other countries.

• The sooner it becomes quick, easy and cheap to comply, the greater the growth they will see from digital sellers in their own country, boosting their domestic economy and tax revenues.

• The simpler and easier these rules become, the harder it will be for anyone to get away with deliberate non-compliance in order to gain a commercial advantage over their law-abiding rivals.

Is there anything you can do about this? YES and you need to do it NOW!

Please circulate this article as widely as possible, as soon as possible, with as many of your business contacts and other networks.

Write to your national tax authority and finance ministry, to your MPs, MEPs, other elected representatives and to any business organisations which you belong to, insisting that the EU act immediately to:

1. Introduce a threshold of €100,000 for cross-border trade (i.e. based on how much you’re selling digitally to the rest of the EU, outside of your home country). As far as your domestic turnover is concerned, your own country’s VAT rules will still apply.

2. Simplify the rules for all micro businesses (i.e. sub-€2m turnover) to allow ONE piece of data as evidence of place of supply, instead of the current 2-3, with that piece of data being the customer location as supplied by the payment processor to businesses using all levels of their services, not just to those purchasing premium options.

3. Immediately suspend these rules for micro businesses, so that they can revert to their domestic VAT rules and pay taxes according to those regulations during the 2 years it could take for the agreed idea of a VATMOSS threshold to become law.

4. Amend the legislation so that all Member States are legally required to direct their VATMOSS communications through the business’s home tax authority for all micro businesses, to remove the threat and fear of receiving demands and ‘system error’ letters from 27 different tax authorities.

One last thing; please take the few extra minutes to contact these people direct rather than using a bulk-emailing service. These websites have become a victim of their own success in flooding inboxes, so letters coming via these routes are increasingly ignored. You can still send the same letter to them all but you will need to copy and paste and send it individually to be most effective.

EU VAT contact email addresses for each country’s tax authority.

EU Finance Ministers – email and Twitter accounts

With thanks from all the EU VAT Action Team.