As part of our negotiations with international governments and the EU Commission, we need to collect as much evidence as possible on what it is costing micro businesses, to try to comply with the new EU VAT rules that came in on January 1st 2015.

The unintended consequences of this legislation on micro businesses and sole traders is enormous – and we need to put numbers in front of key politicians and Decision-Makers to help them understand that this is REAL and not just a whinge-fest.

We’re talking about quantifiable costs in terms of:

- Time to develop solutions

- Up-front costs of tech solutions

- Time & costs to redesign websites and shopping carts

- Upgrading website hosting or servers, to handle the data processing burden

- Costs per sale of any solution / moving to a 3rd party platform

- Administrative hours to manage the process, on-going

- Ceasing trading to non-domestic EU – loss of sales

- Having to offer digital products for free – or scrapping them entirely

- Worst case – ceasing trading completely

And also intangible costs in terms of:

- Delayed / scrapped launches

- Stress

- Opportunity costs

- Reputation loss if no longer selling direct

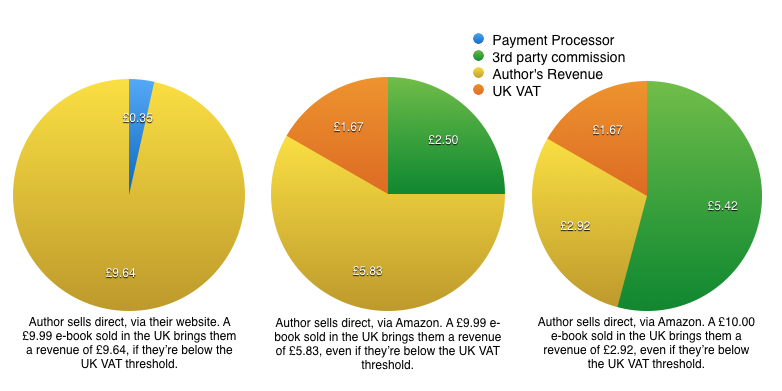

Here’s a simple example – of the costs of a non-VAT-registered independent author who has to move to selling e-books via Amazon, instead of direct to their readers via their own website (click to see the image full-size):

An author selling a £9.99 e-book drops from an income of £9.64 per sale to £5.83 per sale, losing 40% of the former revenue, if they have to sell via a 3rd party platform (which charges 30% commission and covers the payment processing fees). The author also effectively loses their UK VAT threshold, because the 3rd party platform IS VAT registered, so must charge UK VAT to domestic consumers.

In the case of a platform charging 65% (e.g. on Amazon at £10+ sales), they are left with just £2.92 per sale, even if they never make a single sale outside of their home Member State. So the cost of complying with the legislation, in that case, becomes a 70% cut in income.

Amazon uses this higher commission figure to try to force authors to sell at lower prices. Also Amazon restricts which countries you can sell in, so authors are no longer able to sell worldwide, which is a massive cost of implementing the new Digital VAT rules. Additionally, Amazon and Apple customers also experience persistent problems with purchasing books whilst travelling, which has a negative impact on the author’s reputation.

If they don’t sell via a 3rd party platform, then most cannot continue to trade, because the costs, complexity of compliance and administrative burden far outweigh anything that is reasonable on low-priced products.

It is easy to see that the cost of compliance in this case is disproportionate.

We want to collect hundreds more cases like this.

If you have experienced costs in complying with the legislation, please could you urgently let us know. Either tell us via the comments, or let us know in this discussion thread in our super-friendly and super-helpful Facebook group.

Thank you so much for your help!

Clare & the EU VAT Action Team