We are hugely grateful to the MEPs who succeeded in scheduling this evening’s debate on EU VAT in the European Parliament. However, we are also disappointed in the EU Commission’s official response from VP Andrus Ansip, who is responsible for the Digital Single Market (DSM) and who represented Pierre Moscovici (the EU Commissioner responsible for Tax and the recipient of the EU VAT petition).

VP Ansip agreed that the new EU Digital VAT rules are posing a huge problem for SMEs and micro businesses. That is an amazing achievement. Thank you everyone.

He also reminded the European Parliament today that the EU Commission (which proposes the laws) suggested a threshold of €100k back in 2004 (this would make it best part of €140k now), but it was voted down by individual Member States’ Finance Ministers, which is why there is no threshold – and this is why your business is suffering.

He said that there will be a report ‘this summer’, after which they EU Commission will decide whether / when to make proposals to change the EU VAT legislation to remove the burden from the smallest businesses. In a separate statement this evening he said he envisaged proposing the legislation in 2016 – in addition to last week’s promise to extend the rules to apply to ALL online sales (i.e the stuff that is currently exempt) after 2016, by which point the DSM – and possibly your business – will be long-gone.

The problems with this?

Now don’t get us wrong, we’re not trying to be ungrateful, it’s just that:

- VP Ansip knows that most of us cannot comply – it’s not just difficult. It’s impossible for most of the smallest businesses, without radical restructuring of our businesses and potential 5-figures in costs – all to collect peanuts for other EU Member States. He knows we’re being forced to drop digital goods or close our businesses. We have had meetings with his core advisers, so he cannot deny knowing this. Waiting until 2016 before the yawningly-slow legislative process even starts is a miserable prospect.

- Yes, he is offering a potential threshold of €100k (about £71,000), and that is, in itself, incredible progress. But what are businesses above this threshold supposed to do? There is still no solution for them. The legislation is so complex that even a household name multi-billion turnover company got stressed about it (we have that off-the-record). Here’s a recent article on why a €100k threshold isn’t a magic fix-all.

- He is still not suggesting any kind of simplification or reworking of the legislation for those above any threshold, to allow them to keep trading, (for example to allow just one piece of data as proof of place of supply for those below the official EU Audit threshold (2m).

- The ‘report’ he mentions is, we believe, being created by a consultancy firm who attended a breakfast meeting, hosted by Vicky Ford MEP (thank you!), at which we delivered the Keynote speech in late March 2015. The primary representative from the consultancy firm refused to take our contact details and refused to work with us in any way on the report, despite us having interviewed nearly 2,500 micro businesses in our quantitative research study, EU-wide. So we have minimal faith in the output of his report. After all, it is ‘consultants’ who told the EU over the past 10+ years that no micro business would be affected by these new rules, because none of us sells direct to consumers or outside of our home country…

- If VP Ansip hasn’t even decided when to propose the legislation, which could still take years to debate, then your business will be long-closed before the legislators and report-writers have consumed enough coffee to reach a recommendation.

Bottom line: VP Ansip and VP Timmermans have publicly admitted that this legislation has had devastating unintended consequences for the smallest businesses.

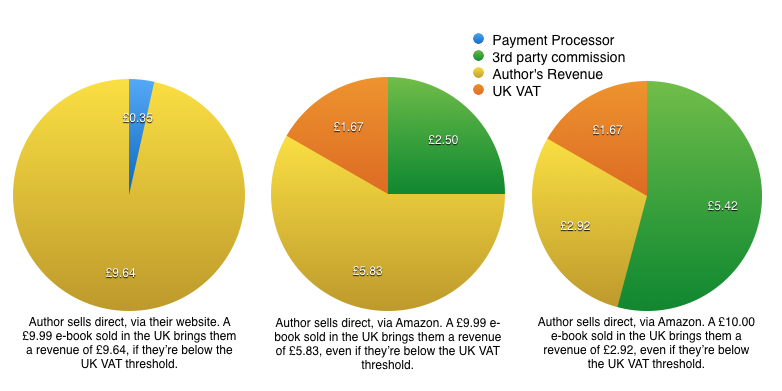

The EU is not acting in any way fast enough to keep you trading and the costs of compliance are vastly disproportionate to the amounts of EU VAT collected.

They have admitted they always assumed that micro biz wouldn’t be affected – it was never meant to hit you.

But they’re not planning to even start doing anything about it until next year.

But you can still make a difference!

Between us, we have given the EU plenty of time to get this sorted. Yes, it is brilliant that the MEPs and EU Commissioners now agree that the unintended consequences of this legislation are severe. They promised, back in March, to ‘urgently remove this burden from SMEs’. Unfortunately a 100k threshold with no reworking of the law above that point, and not even considering starting the slow legislative process until ‘after the summer’ doesn’t come close to fulfilling that promise.

So now it’s down to your national Government.

Each of us needs to lobby our Member State Government to immediately suspend this legislation for Microbusinesses (the EU definition is <€2m turnover), while the EU sorts out the mess it has created and those Microbusinesses go back to their domestic VAT laws. In the UK, for example, this would be called a ‘temporary Extra Statutory Concession’ and it could be implemented very quickly, if the government wants to keep small businesses trading.

Your government DOES have the power to do this – even if it might make it unpopular within the EU… But surely protecting the businesses who the EU admits have been accidentally hit hard by the unintended consequences of these ill-thought-out rules is more important than being told off by the Head Teacher?

We implore you to write to your MP (government representative) and your Finance Minister to explain how these new rules have hurt your business and to explain that you need an immediate suspension for micro businesses, to allow you to keep trading, while the EU figures out how to undo this mess.

Your government CAN save your business.

This article tells you how to get in touch with your national Finance Minister.

And for UK readers, here’s how to contact your MP.

We are happy to include links for other countries, if you could let us know them via the comments.

You are welcome to send them our interim impact assessment report that has been widely circulated within the European Parliament and Commission.

And you might want to ask your Finance Minister what the net revenues were that they received in April (Q1 of the legislation), after deducting the costs of collection and excluding the revenues from the big companies like Amazon. We strongly suspect these figures will be much lower than the Member States promised each other when they were getting excited about the juicy financial cherries this legislation would bring them.

Together we CAN make the difference that is so desperately needed. Even getting the EU to talk about thresholds is an astonishing achievement. Proving the negative consequences – unintended – of these rules is a done deal. So now we need to reclaim our power to convince our Governments that they need to take decisive action to help their own citizens.

Please let us know via the comments how you are able to support with this Action Challenge. Please share any useful contact details you come across via the comments, along with any replies you get. We are hugely grateful to you for all actions you take.

Thank you so much for your on-going support. Please join us over at the EU VAT Action Campaign Group on Facebook to stay up-to-date and to continue being part of the solution.

Clare & the EU VAT Action Team